Whether you’re creating a plan for the first time or updating an existing one, estate planning can be stressful. There are more estate planning tools than many people realize. An experienced attorney can help you select which ones work best.

One especially effective estate planning tool is the enhanced life estate deed, more commonly known as the Lady Bird deed. Here’s what you need to know about Lady Bird deed law in Texas and how to determine whether a Lady Bird deed is the right choice for you.

Lady Bird Deeds: The Basics

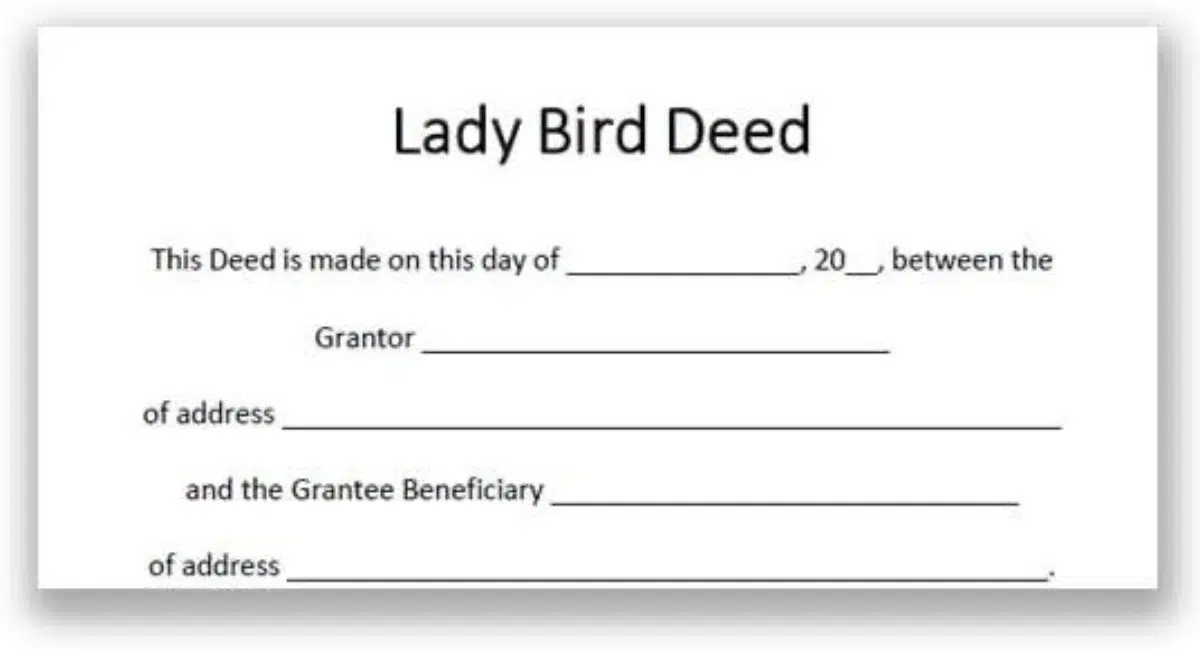

The process of transferring real property after death can be complex. Lady Bird deeds offer homeowners a way to ensure that their property passes quickly to their chosen beneficiary after death. Each Lady Bird deed concerns two parties:

- The life tenant or “grantor” is the current owner of the property

- The beneficiary (sometimes called the “remainderman”) receives the property after the life tenant’s death

When a homeowner creates a Lady Bird deed, they retain the right to live in and manage the property for the rest of their life. After the homeowner’s death, the property automatically transfers to the beneficiary.

Notably, the homeowner isn’t bound by the deed. They’re free to change beneficiaries, otherwise update the deed, or revoke it at any point.

Is a Lady Bird Deed Legal in Texas?

Lady Bird deed laws make it possible for property owners to incorporate enhanced life estate deeds as part of a comprehensive estate plan. These deeds aren’t available in every state, but fortunately, they are legal in Texas.

Texas is one of five states that offer Lady Bird deeds as estate planning tools. (The other states are Florida, Michigan, Vermont, and West Virginia.)

However, it’s important to understand that each state sets its own laws and regulations concerning enhanced life estate deeds. A Texas Lady Bird deed is not identical to a Lady Bird deed in Michigan or Florida.

You might wonder if the name “Lady Bird deed” comes from a specific law. However, there is no “Lady Bird Deed Act” or similarly named statute. Instead, the name comes from former First Lady Claudia “Lady Bird” Johnson.

A Florida lawyer named Jerome Ira Solkoff used the names of President Lyndon B. Johnson and Lady Bird Johnson when illustrating the concept of an enhanced life estate deed in his estate planning book, and the name stuck.

Key Features and Legal Recognition of Lady Bird Deeds in Texas

Lady Bird deed law in Texas can be complex. Before deciding whether an enhanced life estate deed is right for you, it may be helpful to take a look at some of its main features.

The Beneficiary’s Right to the Property Isn’t Guaranteed Until the Grantor’s Death

Because the grantor has full control of the property until their death, they may sell the property or cancel the deed. However, once they pass, the property is automatically transferred to the beneficiary.

The Transfer Doesn’t Trigger Gift Taxes

Although the grantor creates a Lady Bird deed while they’re alive, the beneficiary receives it after their death. As a result, federal gift taxes don’t apply.

The Deed May Improve Your Chances of Medicaid Eligibility

If you hope to qualify for Medicaid to cover long-term care, your assets must be below a certain threshold. In many cases, if a property has a Lady Bird deed, it doesn’t count toward the Medicaid asset limit.

Your Home Won’t Have to Go Through Probate

If you leave your home (or other property) to someone using a will, the document must go through probate court first. This means that your beneficiary may have to wait quite some time before taking control of the property.

Because a Lady Bird deed streamlines the transfer, your beneficiary should be able to receive the property much more expediently.

Advantages of Using a Lady Bird Deed in Texas Estate Planning

Before implementing a Lady Bird deed or any other estate planning tool, it’s wise to make sure you thoroughly understand its benefits and limitations.

While it’s a good idea to discuss your wishes with a Lady Bird deed lawyer, doing some research on your own beforehand can help you make an informed decision. Here’s a look at some of the key advantages of using a Lady Bird deed.

You Maintain Complete Control of the Property During Your Lifetime

With a traditional life estate deed, the beneficiary’s consent is generally required to remortgage or sell a home. They may also have to grant permission to perform major renovations.

One significant advantage Lady Bird deeds have over standard life estate deeds is that they give the property owner total control of the property until their death. If you have a Lady Bird deed, you’re free to refinance, alter, or even sell the property at will prior to the property transfer.

You Can Pass Down Your Property While Avoiding Probate

Avoiding probate is another major benefit of Lady Bird deeds. Probate is a process of “validating” a deceased person’s will through the courts. It tends to be a long, complex, and often expensive process.

A Lady Bird deed keeps the property out of probate court entirely. Instead of having to go through the protracted probate process, the property goes directly to the intended beneficiary after the property owner’s death.

The Property Is Shielded From Creditors

The fact that a Lady Bird deed can help you eschew probate is important for another notable reason — it shields the property from claims by creditors.

If someone dies owing money to creditors, those entities may attempt to claim some of their property during probate. Since a Lady Bird deed bypasses probate entirely, creditors do not have a chance to make a claim against the property before it goes to a beneficiary.

The Property Is Protected From Medicaid Estate Recovery

Many people plan to receive Medicaid benefits if they need long-term care. When they do so, their estates may be subject to Medicaid estate recovery. This is when Medicaid attempts to seize an estate to recoup what it spent on long-term care.

One of the distinct advantages of a Lady Bird deed is that it insulates the property from Medicaid estate recovery. This ensures that the property will go to your intended beneficiary, not the government.

It’s One of the Most Flexible Estate Planning Tools

Estate planning can be nerve-racking for a number of reasons. For many Texas property owners, committing to a permanent course of action is one of the biggest stresses of estate planning.

Unlike many other estate planning documents, a Lady Bird deed is completely revocable up until the grantor’s death. If you create a Lady Bird deed, you’re free to modify or cancel it for any reason at any time.

When to Use a Lady Bird Deed vs. Other Estate Planning Tools

The impact of the Lady Bird deed in Texas estate plans is generally positive. However, each person’s estate planning needs are different, so there are some situations where using a different estate planning tool might be a better choice.

Generally, a Lady Bird deed is a useful measure if:

- You want to retain control of the property during your lifetime

- You’re trying to protect your property from Medicaid estate recovery

- You want to simplify the transfer of the home to your designated beneficiary

- You want the option to change or revoke the deed at any time

If you have different goals, however, it’s worth exploring your options.

Consulting an experienced estate planning attorney is the best way to make sure you choose the right tools. That said, here are a few situations where you might go with an alternative:

Your Primary Goal Is transfer property

Lady Bird deeds offer a good amount of flexibility, but that means the process of creating one can be somewhat complex. If you want to transfer property upon your death but don’t need the extra pliability that comes with a Lady Bird deed, a transfer-on-death deed may be a faster, easier solution.

Your Primary Goal Is Minimizing Property Taxes

Lady Bird deeds present some clear tax advantages. However, they may not have much of an effect on the property taxes your beneficiary will pay. A trust will often have greater tax advantages for the beneficiary.

You Want to Name Multiple Beneficiaries

Technically speaking, a Lady Bird deed can include multiple beneficiaries. However, granting the property rights to more than one person can cause family disputes. If you want to leave your primary residence to multiple beneficiaries, a qualified attorney can help you decide whether a Lady Bird deed is the best way to do so.

You Want to Name an Alternate Beneficiary

If you want to make sure your home stays in your family (or be able to choose which family member receives the house), you may want to name an alternate beneficiary. This person stands to inherit the property if your beneficiary dies before claiming the home.

With a Lady Bird deed, you generally can’t name an alternate beneficiary. If naming an alternate is important to you, consider creating a trust instead.

Working With a Texas Estate Planning Attorney for Lady Bird Deeds

Lady Bird deed law in Texas can be highly nuanced, and even a simple error in the creation of the deed can lead to big problems down the line. When creating one of these legal documents, it’s important to seek the help of a knowledgeable estate planning attorney.

Hunter Sargent, PLLC, has helped Texas property owners secure their legacies for seven generations. We take pride in building a comprehensive estate plan for each client, and we’re committed to finding personalized solutions that meet your needs.

If you’re looking for a dependable Lady Bird deed attorney, call us today to start putting your plan in place.