When the average person imagines estate planning tools, they think of wills and trusts. However, as any estate planning attorney can tell you, there’s a wealth of property transfer vehicles and other tools to simplify asset distribution and protect your loved ones from the threat of creditors.

One of the most useful tools out there is the enhanced life estate deed, better known as a “Lady Bird deed.” This powerful legal document allows Texas homeowners to pass properties directly to heirs after their death, and it also offers several other benefits.

This in-depth guide will explain how to file a Lady Bird deed in Texas and provide useful tips to help ensure your success.

Understanding the Lady Bird Deed in Texas

Many states allow homeowners to transfer property to their loved ones using traditional life estate deeds. However, only a few states — including Texas — permit property owners to transfer a home using an enhanced life estate deed, which is more commonly referred to as a Lady Bird deed.

Both types of deeds allow the owner of the home (the “life tenant” or “grantor”) to live in it for the rest of their lives. When the grantor dies, the property is transferred to a recipient (a “remainder beneficiary” or “remainderman”). For example, a parent might create a life estate deed to ensure that their home goes to their child after their death.

A Lady Bird deed shares many similarities with a traditional life estate deed, but there are a few key differences. With a traditional life estate deed, the grantor generally can’t change the beneficiary designation. They also typically can’t do any of the following without the permission of the remainder beneficiary:

- Sell the property

- Remortgage the property

- Make any substantial additions or changes

A standard life estate deed might make transferring property simpler, but it substantially restricts a homeowner’s freedom during their lifetime. An enhanced life estate deed solves that problem.

With a Lady Bird deed, the homeowner retains complete control over the property during their lifetime. They may sell it, change beneficiaries, or even revoke the deed entirely.

Texas is one of only five states that recognize Lady Bird deeds. The others are West Virginia, Florida, Vermont, and Michigan.

Advantages of Lady Bird Deeds

Lady Bird deeds can provide several advantages for you and your loved ones. Here are a few of their main benefits:

They Keep Your Home Out of Probate

Probate is the legal process of distributing a person’s assets after their death. It’s lengthy, public, and often costly. While certain kinds of trusts can keep your property out of probate, a standard will doesn’t.

A Lady Bird deed allows you to pass your home down to your remainder beneficiary without going through probate. When your loved ones are grieving, the last thing you want is to subject them to complex, stressful litigation.

They Protect Your Home From Debt “Clawbacks”

You might think that a Lady Bird deed sounds similar to a transfer-on-death deed. While it’s true that both accomplish a similar objective, a Lady Bird deed offers superior protection.

If you die with outstanding debts and leave your home to your loved ones with a will or a transfer-on-death deed, there’s a chance that your heirs won’t actually receive it. That’s because Texas creditors usually have two years after your death to place a lien on your property or seize it if your debts were significant.

This “clawback” process is common enough that most title insurance companies prefer to wait two years to issue a clear deed to the new owner of the home.

As you might imagine, this process can create quite a conundrum for your loved ones.

Fortunately, a Lady Bird deed can help them avoid that headache completely. When you have a Lady Bird deed, your home isn’t technically part of your estate, so you don’t have to worry about debt clawbacks.

You Can Still Enjoy Tax Benefits

Texas has a homestead exemption that protects your main residence from creditors and lowers your property taxes. Because you retain control of your property throughout your lifetime, these benefits still apply.

Your Home Will Be Protected From Medicaid Estate Recovery

Many people rely on Medicaid to cover long-term care costs. In some circumstances, the government may seek to recoup Medicaid benefit costs by attempting to seize your home or other assets after your death. If you try to pass your home to your loved ones through a will, there’s a real chance the government will take it.

Lady Bird deeds offer a significant advantage here. Because they technically keep your home out of your estate, there’s no opportunity for the government to claim it.

How to File a Lady Bird Deed in Texas: Step-by-Step Process

Filing a Lady Bird deed in Texas doesn’t have to be complicated. However, if you rush the process and make a critical error, you might find yourself facing unexpected legal repercussions.

Because a Texas Lady Bird deed is different from a Lady Bird deed created in Florida or another of the handful of states with enhanced life estate deeds, the best way to ensure that your deed is complete, accurate, and filed properly is to work with an experienced attorney.

That said, it can still be helpful to have a general idea of the steps in the process, which are as follows:

Step 1: Draft the Deed

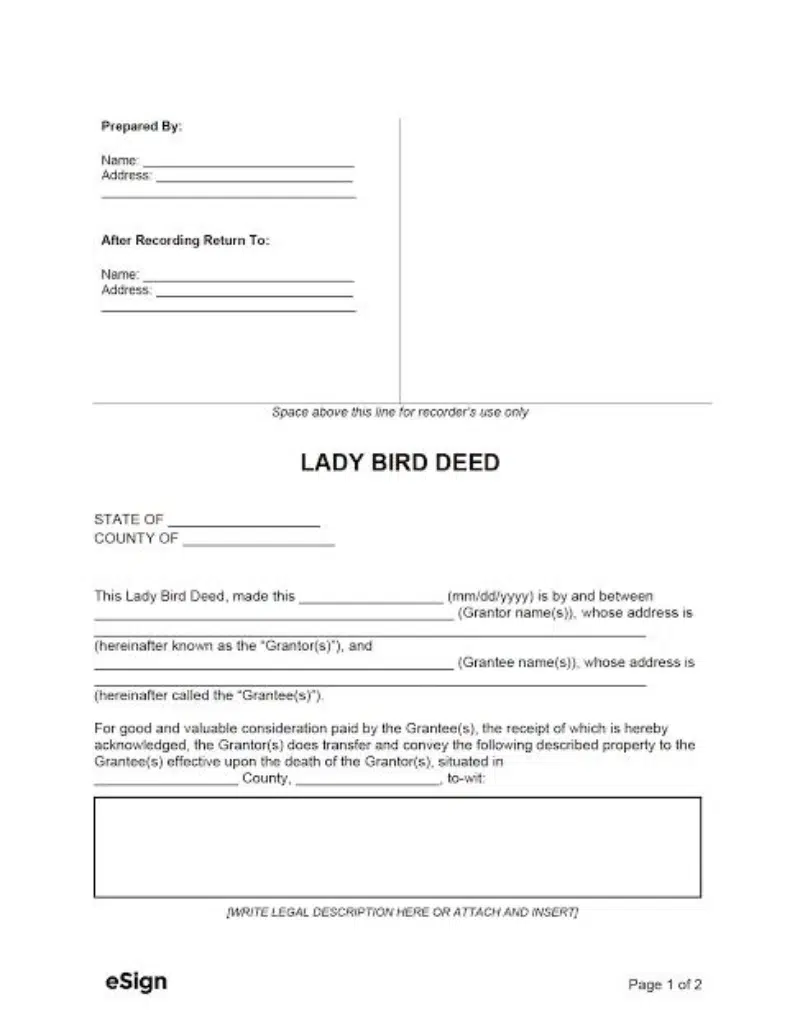

Before you start drafting an enhanced life estate deed, you should be certain that you have a Texas Lady Bird deed form.

Many people make the mistake of searching “Lady Bird deed form” (or something similar) and downloading the first form they see. If you accidentally complete and file the wrong form, there’s a possibility the deed will be considered void.

Working with an attorney is the best way to make sure you have the right Lady Bird deed form. However, if you prefer, you may ask your county clerk’s office for a form.

When you draft your deed, you must include a legal description of the property. This doesn’t simply refer to the street address — the legal description is a much more precise description that identifies the property’s location and boundaries. To register a deed, you might be required to include a sketch or diagram of the property.

Specific counties sometimes have their own unique requirements for the legal description of a property. To reduce your risk of facing problems with your Lady Bird deed in the future, you should take steps to ensure that you understand your city or county’s requirements for legal descriptions.

Step 2: Sign and Notarize the Deed

In order for a Lady Bird deed to be legally enforceable, it must be properly notarized. Once you’ve drafted your deed, looked it over, and confirmed that it’s complete, you must sign it in front of a notary public.

In some cases, it may be wise to involve your remainder beneficiary here so they’ll be clear about what the process entails. However, if your remainder beneficiary is a young child, they likely won’t be able to grasp the idea of future property ownership.

Step 3: Record the Deed

Your Lady Bird deed is effective as soon as it’s signed and notarized — you don’t have to record the deed to make it enforceable. However, once a deed has been recorded (filed with the appropriate local agency), it becomes a matter of public record. That might not seem like an important distinction, but it can help you avoid serious issues.

For example, if Medicaid or a creditor wants to try to seize your home after your death, having your Lady Bird deed already recorded will make it much more likely to stand up to legal scrutiny.

Step 4: Periodically Revisit the Deed

Even if you choose to record your Lady Bird deed, you should still retain a copy for yourself. You keep your copy in a secure place and make sure your remainder beneficiary and other family members know where it is.

Just as you would with any other kind of estate planning document, you should also periodically review your Lady Bird deed to make sure it doesn’t need to be updated. Situations that would likely call for an update include:

- You want to change beneficiaries

- The boundaries of the property have changed

- You want to sell the property

Lady Bird deeds are non-transferable. If you decide to sell your home and buy another (but you want to leave the new home to the same remainder beneficiary), you can’t simply carry the deed over to the new property. You must create a new deed specifically for the new property.

Key Considerations for Filing a Lady Bird Deed Form

Now that you know how to file a Lady Bird deed, you’re ready to get started. However, creating a Lady Bird deed (or using any other estate planning tool) is a major decision, and it’s not a decision to make lightly. Here are a few points to consider when choosing your path:

- Lady Bird deeds can be contested, so you should make your deed as clear and detailed as possible

- Although Lady Bird deeds can shield your property from Medicaid claims, you should still discuss this possibility with your lawyer

- Make sure your intended beneficiary is capable of taking on the property before you create your deed

- Your beneficiary should discuss the tax implications with an attorney, especially if they intend to sell the property

You don’t have to decide whether a Lady Bird deed is the right option on your own. The knowledgeable team at Hunter Sargent, PLLC, can help you weigh the pros and cons and make the best decision for you.

Tips for Filing a Lady Bird Deed Form

If you’re ready to get started with Lady Bird deed filing in Texas, it will help to first review these best practices to ensure success:

Make Sure You Have the Right Form

Although Texas, West Virginia, Michigan, Florida, and Vermont all recognize Lady Bird deeds, each state has its own form. Don’t rely on unverified sources or random internet tutorials to initiate the process. If you do, you might accidentally use the wrong state’s form.

Confirm That You’re Filing in the Right County

Any time you record a property deed, you must do so in the county where the property is located. If you record a deed in the wrong county, it might be legally invalid.

Be Careful When Filling Out the Form

If you aren’t already familiar with Lady Bird deeds, it can be easy to misinterpret parts of the form. For instance, if you didn’t know that the “legal description” of a property means something specific, you might just enter the address.

Consult an Experienced Lawyer

There’s a lot at stake when you register a Lady Bird deed. While you might want to save time and money by drafting one yourself, doing so could result in costly, complex issues in the future.

When you work with a skilled estate planning lawyer, you’ll gain the peace of mind of knowing your deed has been prepared the right way and that your property is preserved for future generations.

Why Work With a Texas Estate Planning Attorney?

Even if you’re confident that you know how to file a Lady Bird deed in Texas, there’s still a chance that you could run into unexpected obstacles. These challenges can be stressful and difficult for the average person to navigate.

Texas estate planning lawyers handle issues with Lady Bird deeds and other estate planning tools on a daily basis. Because they’ve seen the kinds of snags others have encountered, a lawyer can help you avoid common pitfalls.

If you’re considering implementing a Lady Bird deed or other estate planning tool, Hunter Sargent, PLLC, can provide assistance.

We’re committed to helping families like yours secure their legacies, and we take pride in crafting individualized solutions for every one of our clients. Whether you need to draft a Lady Bird deed or you’re ready to build a comprehensive estate plan, get in touch with us today to book your consultation.